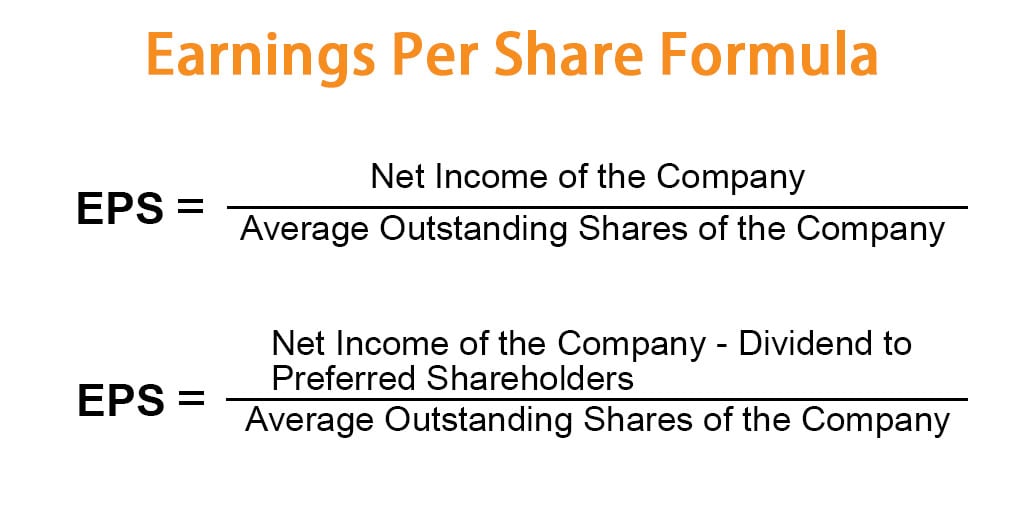

Earnings per share ratio formula

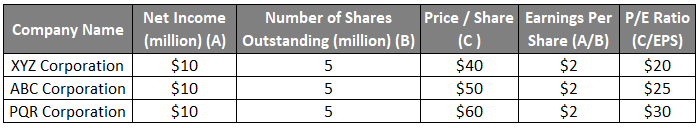

The ratio is used for. Text PE Ratio frac text Market value per share text.

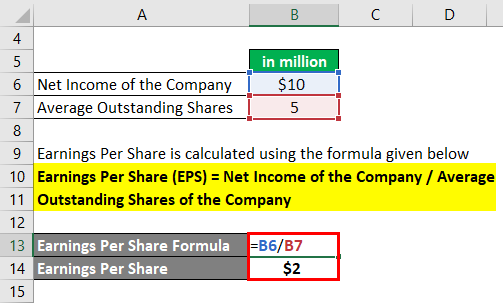

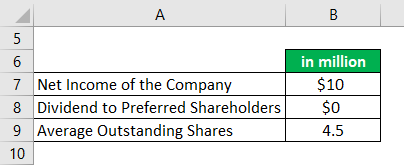

Earnings Per Share Formula Eps Calculator With Examples

Cash Earnings Per Share.

. EPS I - D S. Cash Earnings Per Share Operating Cash Flow Number of shares outstanding OR. The Cash EPS formula can be calculated using one of the following equations.

Here is an illustration of that calculation. From the above data we can compute the earnings per share EPS ratio as follows. The EPS would be calculated as 095 per share.

Solution Earnings per share EPS ratio 224000 80000 shares 28 Net profit attributable to ordinary shareholders 480000 240000 16000 224000. Then you divide the 95 million by the 100 million shares outstanding. Earnings per share EPS measures how much money a company earns from each of its shares of stock and is used by investors to assess the companys profitability.

1500000 180000 158400 1320000158400 833 per share The EPS. The earnings per share ratio will help that investor. Formula Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common shares outstanding.

We have found that the weighted average number of common shares is 70000 new shares. EPS Net income. The EPS calculator uses the following basic formula to calculate earnings per share.

PE Ratio Formula and Calculation The formula and calculation used for this process are as follows. 34 rows The price-earnings ratio also known as PE ratio PE or PER is the ratio of a companys share stock price to the companys earnings per share. Cash Earnings Per Share Operating Cash Flow Number of stocks outstanding OR.

If the company had a. A company with a net income of. Now we can use the formula above to calculate the EPS for the company.

Price per share as of December 14 2018 16548 Annual Earnings per share for year ended Sept 302018 1191 PE Ratio is Calculated Using Formula Price to Earnings Ratio Market. Weighted average shares outstanding is a calculation that incorporates any changes in the number of outstanding shares over a reporting period. The Cash EPS formula is calculated using one of the following equations.

EPS is the earnings per share. You can calculate EPS using the formula given below Earnings Per Share Formula Net Income Preferred DividendsWeighted Average Number of Shares Outstanding The current. Earnings per share ratio is calculated as you subtract the preferred stock dividends from net income and then divide it by the combination of common stock equivalents and all.

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Price Earnings Ratio Formula Examples And Guide To P E Ratio

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Earnings Per Share Formula Eps Calculator With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-02-46d614bf6401446d8a68276252797a11.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Payback Period Formula And Calculator

Earnings Per Share Formula Eps Calculator With Examples

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Basic Earnings Per Share Eps Formula And Calculator

Return On Equity Roe Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Return On Equity Roe Formula Examples And Guide To Roe

Basic Earnings Per Share Eps Formula And Calculator

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Earnings Per Share Formula Eps Calculator With Examples

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Earnings Per Share Formula Eps Calculator With Examples