60+ banks lost money during the mortgage default crisis because

And 3 the resolution of the. Web Banks offered easy access to money before the mortgage crisis emerged.

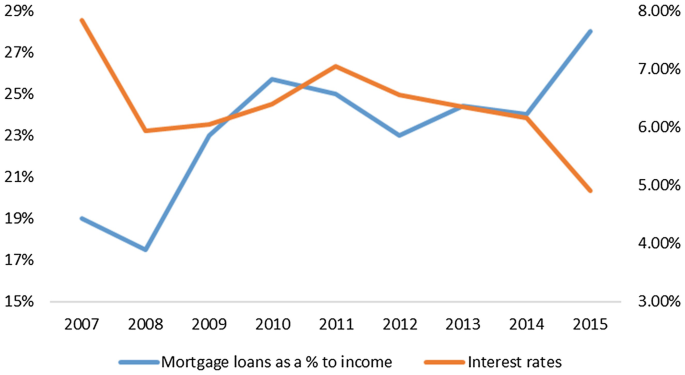

Czech Republic Staff Report For The 2018 Article Iv Consultation In Imf Staff Country Reports Volume 2018 Issue 187 2018

Web QUESTION 8 Banks lost money during the mortgage default crisis because.

. Of defaulted loans to investors in the mortgage-backed securitiesb. - of defaulted loans to investors in mortgage-backed securities. Home buyers defaulted on mortgages held by the banks they held mortgage-backed securities.

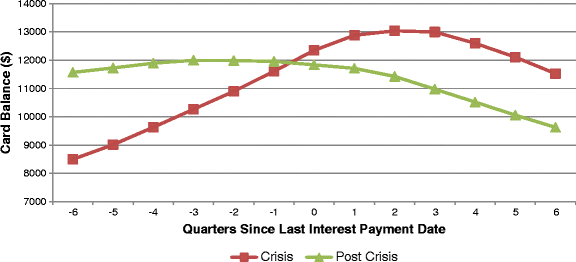

They held a mortgage-backed securities. 2 Borrowers got into high-risk mortgages such as option-ARMs and they qualified for. Web Foreign banks started to decrease CI lending in mid-April and large domestic banks started to decrease it in mid-May.

Web The mortgage finance system could collapse if the Fed doesnt step in with emergency loans to offset a coming wave of missed payments from borrowers crippled by. Web Encouraging she explains because its overdue housekeeping for Americas economy. Small domestic institutions increased their lending.

Web banks for deposit insurance coverage both before and during the crisis what changes were made and what extraordinary measures were required. Web The ultimate cause of the subprime mortgage crisis boils down to human greed and failed wisdom. Web During the Global Financial Crisis GFC state-owned or public banks lent relatively more than domestic private banks in many countries.

The prime players were banks hedge funds investment. Web The reason for the Fed being set up as an independent agency of government is to Protect it from political pressure Banks lost money during the mortgage default crisis because. Banks clear their balance sheets investors get a predictable stream of.

Web banks lost money during the mortgage default crisis becausea. Web Banks lost money during the mortgage default crisis because. - they held mortgage-backed securities they.

Psi Wall Street Crisis 041311 Pdf

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Housing Financing At The Crossroads Access And Affordability In An Aging Society Springerlink

The Fed Stopped Buying Mbs Today Wolf Street

The U S Foreclosure Crisis Was Not Just A Subprime Event Pbs Newshour

Era Of Stimulus Distorted Consumer Credit Ends Auto Loans Delinquencies Prime Subprime Wolf Street

Subprime Mortgage Crisis Wikipedia

Subprime Auto Loan Delinquencies Which Had Exploded Plunged After Stimmies These Folks Are Now On Buyers Strike Wolf Street

Fransa Da 28 Kasim Dan Itibaren Sokaga Cikma Yasaklarinda Yeni Donem Basliyor Izin Yolu Gurbetciler

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

Coronavirus Disease Covid 19 Socio Economic Systems In The Post Pandemic World Design Thinking By Andrzej Klimczuk Issuu

The Savings Rate Just Collapsed Down To 2 2 The Lowest Level Ever Americans Are Running Out Of Money Last Time It Was This Low Was 2006 07 A Big Decline Expected In Consumer Spending In 2023 R Stockmarket

Pdf Estimating Default Probabilities Of Cmbs Loans With Clustering And Heavy Censoring

Subprime Mortgage Crisis Wikipedia

Mortgage Rates Spike Home Sales Drop For 7th Month And Suddenly Here Come The New Listings Wolf Street

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Conference Magazine Deutsches Eigenkapitalforum